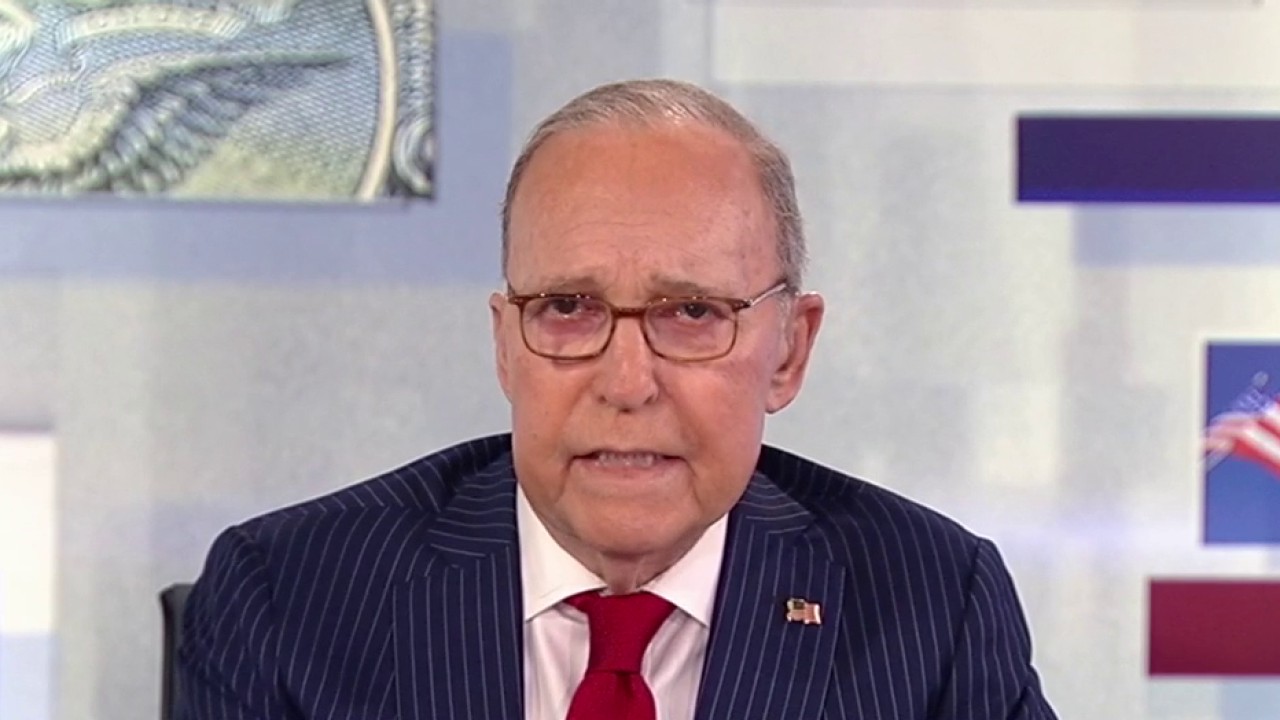

Larry Kudlow: Imagine Reagan-Trump, not Nixon-Ford on Tax Discounts

Fox Business Host Larry Kudlow opens tax reduction and growth policy in 'Kudlow'.

The Senate Most Leader John Thune has set the date of April 11 for a recent agreement between the budget resolution by budget resolution by budget resolution President Donald Trumps “One, big, beautiful” tax-cut bill.

Let's hope he is right. Let's hope both houses meet the deadline. And there is a lot of work to do.

For some conservatives, the Senate Republicans become fashionable to beat to go very slow.

Perhaps the chairman of the Senate Finance Committee is working hard on Mike Crapo “One, large, beautiful” bill.

A multiple senators are trying to translate Dog Budget deposits of Elon Musk Enter the more rescue packages that will return the costs that generate at least one and perhaps the voucher.

There is a senate budget package for border, deportations, energy reform and military growth. Mr. Crapo should not be very difficult to close the tax-cut plan.

However, the house has a lot of work.

Fox News High Congress Chad Pergram, President Donald Trump's 'Kudlow' also shows a quick extension of previous tax intersections.

The speaker is a miracle that Mike Johnson's budget passes and I'm glad to have the first blood.

But there are many problems with the home budget resolution.

For one, do not Trump tax permanently decreased.

For the other, the senator is not included in the main database of the current policy of the crapo, the tax reduction is permanent on a neutral basis. Previous President Barack Obama was used to reduce the permanent tax earlier that should not be rebuilt a few years ago a few years ago.

Instead, it made a thin connection between home spending and tax reduction. This is a big mistake.

Nixon-Ford Republicans always reminds the years of re-reagan when waiting for the deficit before cutting taxes. And they never cut off the taxes because they never cut or expend.

Fortunately, Reagan broke the high tax dogma.

However, some housewives fell into this tax trap.

'KUDLOW' panelists discussed the growth and inflation of Steve Forbes, Art Laffer and Steve Moore responded to the growth and inflation.

Another problem for both Senate and home Republicans Trump tax discounts 2.0 is only applied because of the existing policy base Trump Tax Cuts 1.0.

President Trump's promised tax free tips, work hours, social security benefits, 15% of the 'corporate tax cut and 100% retroactive, but do not fall under this rule.

You were able to put it all together in a bill. But it remains to be seen.

And this requires a large league dynamic increase to take into account the growth of the supply side of the laffer curved income.

In other words, both republican homes are still throwing a long stone from a tax-cut blue color.

But seal the Donald Trump deal in the Ronald Reagan Spirit.